- ZenTrader

- Posts

- Market Levels, Sector Rotation & Watchlist

Market Levels, Sector Rotation & Watchlist

Key Levels Hold as Traders Head Into the Holiday

Today’s Market Close

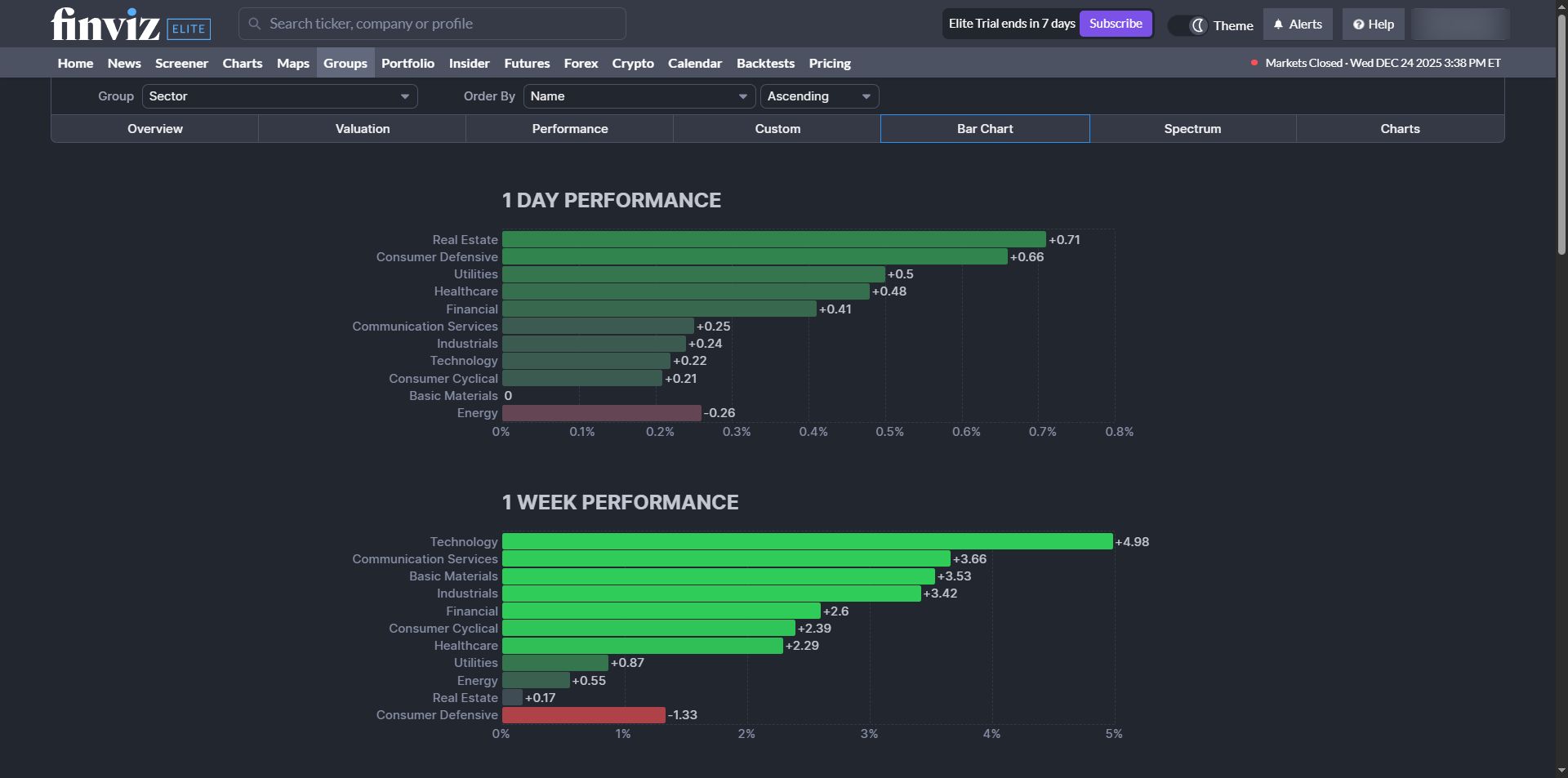

Sector rotation remains constructive: Real Estate, Consumer Defensive, Utilities, Healthcare, and Financials led on the day, while Energy was the lone laggard. On a one-week basis, Technology and Communication Services continue to dominate, confirming risk appetite remains firmly intact despite mixed daily leadership.

Yesterday’s Price Action

What Happened Yesterday?

This is what bull markets look like, and it’s critical to keep this framework in your knowledge bank.

Yesterday morning, we said that Monday’s opening price would be important, especially because this is a short holiday week. That turned out to be true.

The QQQ opened lower, but buyers stepped in during the first hour. The price moved back above Monday’s high and even above Monday’s opening price. Because the market moved back and forth and a holiday was coming up, there wasn’t much reason to make big moves—and that’s okay.

The lesson remains simple:

When strong stocks trade lower in bull markets, we focus on buying opportunities.

Major Index & Macro Overview

S&P 500

Current Price: $689.94 / All Time High: $691.19

Up ~17% YTD

Trend remains intact

Sentiment supported by stimulus expectations, deregulation hopes, and AI optimism

Nasdaq

Current Price: $623.22 / All Time High: $630.20

Up over 20% YTD

AI continues to dominate positioning

Expect volatility as participation narrows

Dow Jones Industrial Average

Current Price: $486.79 / All Time High: $489.66

Holding structure

Industrials and financials remain important contributors

Bitcoin

Current Price: $87,570 / All Time High: $90,536

Continues to influence risk appetite

Volatility feeds directly into tech and speculative growth

Precious Metals

Gold: Current Price: $411.69 / All Time High: $415.42

Silver: Current Price: $65.18 / All Time High: $65.67

Gold and silver pushing higher

Safe-haven demand + rate uncertainty driving momentum

Sectors

Positive Sectors Today

Basic Materials

Gold (GLD) and silver (SLV) accelerating

Strong continuation across metals

Steel

Bullish stacked order flow remains intact

Entry zones remain favorable

Financials

Moved into the #2 sector over the last four weeks

Momentum strong as longer-term order flow begins to align

ZenTrader’s Watchlist

AMD

AMZN

AAPL

BA

CAT

Swing Trade

Financials – Asset Management Focus

Financials continue to deliver, and Asset Management stands out within the group.

Names on our radar:

KKR – Pullback into an inside day, setting up a potential swing entry

TPG – Holding trend support

PNC – Clean structure within sector strength

This is a textbook example of allowing longer-term order flow to catch up with recent momentum.

Industry Group Snapshot

Bullish Industry Groups

Software Application: CRM, SHOP, ADBE, TEAM, FROG

Credit Services: V, MA, AXP, COF, SYF, ALLY

Banks: JPM, C, RY, HSBC, TD, BK

Airlines: DAL, UAL, LUV, LTM, ALK

Asset Management: BX, KKR, APO, ARES, STT, NTRS

Bearish Industry Groups

Computer Hardware: PSTG, SMCI

Healthcare Information Services: VEEV, TEM, DOCS, WAY

Diagnostics & Research: A, DGX

ZenTrader Note

This market continues to give participants just enough data to confirm their existing beliefs. That’s why we stay grounded in price, structure, and probability — especially during holiday weeks.

Volatility isn’t a risk.

Being unprepared is.